Exploring Prediction Markets and Equity Research

Intro:

The Alternative Alpha brand has now rolled into the Clarity Markets brand. This blog used to be solely dedicated to covering our CVNA alternative data. We still cover that (and KMX/CDLX) via our website, but aim to significantly expand our coverage in the future. As a result, this blog will just be about general Clarity Markets things, which includes in-house alternative data, interesting public data trends, and of course prediction markets.

As an idea, our future blogs will cover trends we’ve seen in Make/Model of the used car industry, Google trends and social media stats for retailers, consensus expectations for inflation, shifts in geopolitical expectations such as Taiwan invasion possibility, etc. The goal is to provide readers with a variety of data points on current topics, hopefully providing some “clarity” to their worldview. If that sounds interesting, feel free to subscribe now

Intro (To the article this time):

Clarity Markets currently is home only to alternative data coverage of a few companies. The goal is to expand that dramatically over time with the help of prediction markets.

If you are unfamiliar, prediction markets are essentially platforms where one can trade opinions. Users can buy “Yes” or “No” tokens for questions like “Will Jerome Powell say “inflation” during his next press conference?” These Yes and No tokens trade around an implied odds from 0%-100%. If I believe he absolutely will say inflation, I can buy Yes tokens at the market rate of 90% and get my snazzy ~10% return next month. If he doesn’t, my Yes tokens are worth 0 and the No tokens 10x from 10% to 100%.

Prior to 2024 prediction markets were for the most part a niche hobby for those with an extreme interest in politics that wanted to trade election results. After a variety of legal battles around regulation, we’ve started to see them enter the mainstream with numerous billions of dollars of volume on things such as Trump’s election odds. They’ve even started eeking their way into the finance world with some small rollouts at Robinhood and IBKR if you’d like to trade weather events and sports from your brokerage.

There are a variety of companies in the space today such as Kalshi/Polymarket/Manifold/PredictIt/etc. Some utilize real money for their markets, others utilize fake currency. At the core, all that really matters for the purpose of research is how well they can answer questions, and the evidence thus far points to pretty well.

That idea is why we plan to roll-out some tests with a prediction market on our platform in the coming weeks (more on that in later blogs). For now, let’s dive in to the article.

Navigating Uncertainty:

I believe it’s safe to say we are currently experiencing uncertain times. Irrespective of politics, the current administration has created a significant amount of business and geopolitical uncertainty in recent months with the VIX index hitting levels not seen since 2020 Covid.

From an investing perspective, the best we can hope to do is try and get an understanding of both what’s actually happening, as well as what consensus believes is happening. That is where I believe prediction markets and data can be of great help.

Below I’m going to go through a variety of topics that have existing markets and cover where consensus is at in those markets. This is a blog format I haven’t done before, but am considering making recurring coverage. If you love it or hate it, feel free to let me know!

As a reminder, the way these markets work is questions either resolve “Yes” or “No” to 100%, but trade at an implied odds in the meantime. They have order books and market makers. Due to option value and time value of money, odds near extremes such as 0-5% or 95-100% may err farther from 0/100 than the market actually expects. Afterall why lock-up money for 1 year to buy a 99% Yes where you make 1% if you’re correct?

Taiwan Invasion Risk:

With geopolitical tensions rising, particularly with China, the Taiwan question has popped up a bit more lately. Below I’ve compiled predictions from Polymarket (real money) and Manifold (fake money). The consensus on these actually hasn’t changed much despite recent tariff shenanigans. These markets do believe it’s roughly a coinflip that China and Taiwan have a military clash sometime in the next decade. That timeframe is long enough to be of questionable accuracy given option value/time value of currency, let alone the decade between there and now, but I thought it worth highlighting where consensus is currently pegged. Plugging said expectations into a model for TSM can be an interesting exercise.

Polymarket:

Manifold:

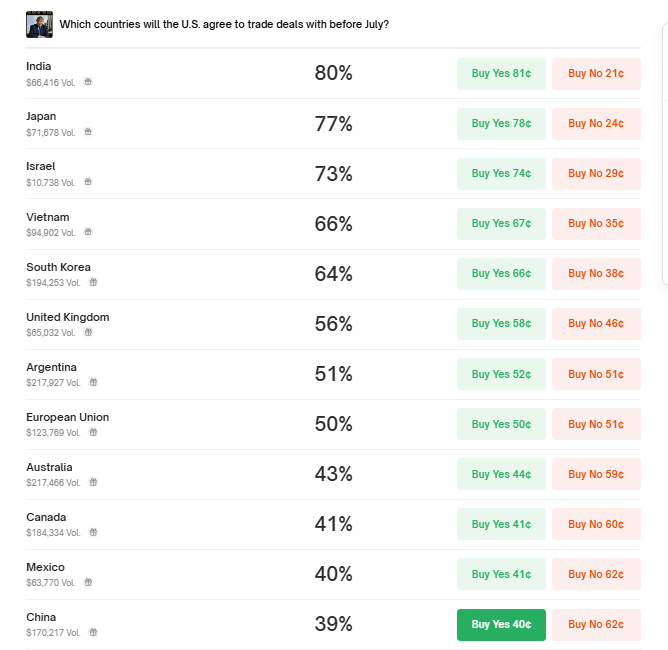

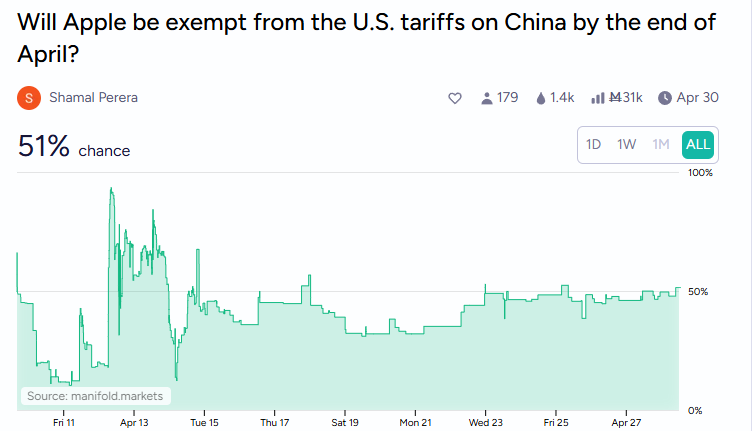

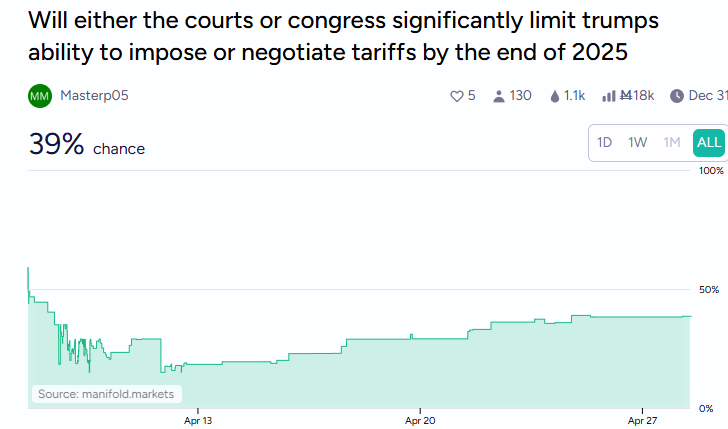

Tariffs:

Tariffs are front of mind for many given the broad impact to companies both large and small. In aggregate, the prediction market consensus is that a deal with China is likely to happen, but only to lower tariffs, not remove them. The markets also believe the reciprocal tariffs in general will be reduced/removed before the deadline. The general read seems to be that the tariffs have a predominantly Chinese focus without much sticking power elsewhere besides Mexico/Canada.

Polymarket:

Kalshi (real money):

Manifold:

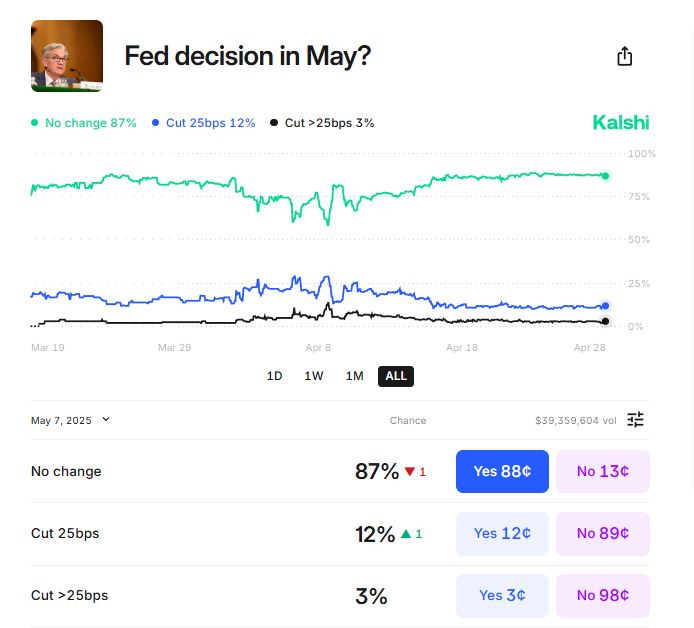

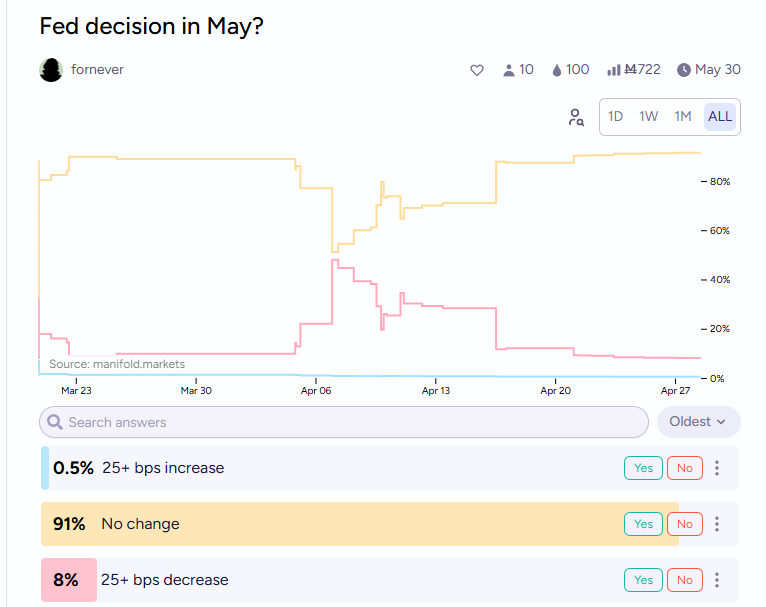

May Fed Decision:

Macro economics can be fun to spectate given the many moving parts. We can clearly see rate cut expectations moving significantly upwards in early April when tariff chaos was getting started. As things have slightly stabilized, expectations have moved back towards consensus of no cuts in May. These rates markets have tens of millions of dollars in volume which is substantially higher than many other markets on the platforms. The Manifold website tends to skew more politics and has less volume on these macro questions.

Kalshi:

Polymarket:

Manifold:

2025 Rate Cuts:

Overall rate consensus for 2025 is all over the place, with a relatively even distribution from 0 to 4 cuts, skewed towards 2/3. Expectations have come down from peak uncertainty in early April, but are still higher from the start of the year likely related to recession risk.

Kalshi:

Polymarket:

Manifold:

Recession in 2025:

A result of trade being all over the place is of course recession risk. The consensus here has exploded up from ~20% at the start of the year during initial Trump election euphoria to ~60% currently. This is despite expectations for Q1 GDP to be positive real growth, implying high odds for negative comps for Q2-Q4. The odds here have only slightly come down from highs despite beliefs that tariffs will come down meaningfully later in the year.

Kalshi:

Polymarket:

Manifold:

Kalshi GDP:

Polymarket GDP:

TTWO and GTA6:

As a sample of what can be possible for single stock KPI’s, markets like these trying to predict the release date of GTA6 can be interesting.

Kalshi:

Conclusion:

Our future vision for Clarity Markets is to have a variety of single stock and market wide KPI’s that answer key questions for whatever you may want to know. This blog (and our website data subscriptions) can then be used to disseminate high signal consensus on what matters most.

We’ll also explore a variety of other topics, with an upcoming blog exploring trends in used car sales. For now, all blog posts here will be free as we establish core coverage and cadence.